Briefly Explain the Difference Between Absorption Costing and Variable Costing

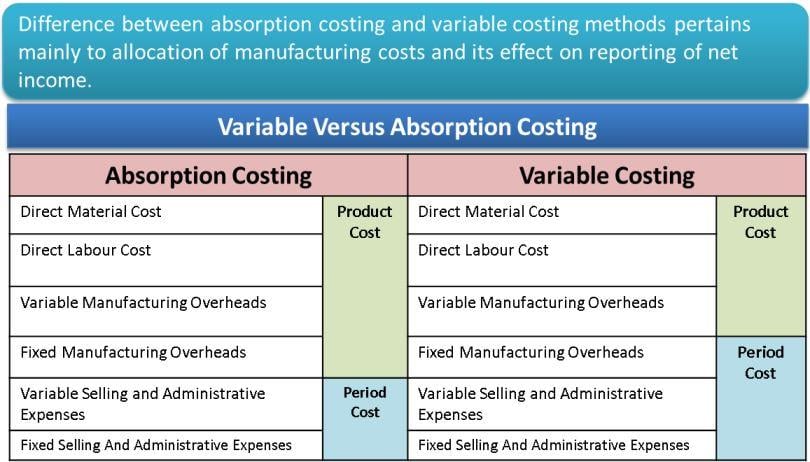

In contrast to the variable costing method absorption costing may provide a fuller picture of a products cost by including fixed manufacturing overhead costs. Absorption costing follows the format of gross margin whereas variable costing follows the format of contribution margin.

Absorption Vs Variable Costing Resulting Difference In Operating Income

Briefly explain the difference between absorption costing and variable costing.

. The reason is that the fixed manufacturing overhead cost is not treated the same way under two costing methods. In absorption costing Variable and FMOH is a product cost An income statement. TUTORIAL 5 Chapter 8 QUESTION 8-1 Briefly explain the.

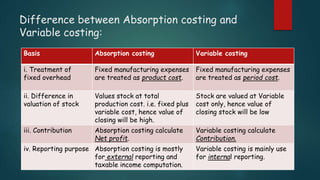

To understand how the difference in treatment of fixed manufacturing overhead cost changes the net operating income figures of two costing. Both the Marginal costing and absorption costing are the two different approaches used for valuation of inventory where in case of Marginal costing only variable cost incurred by the company is applied to the inventory whereas in case of the absorption costing both variable costs and fixed costs incurred by the company are applied to the inventory. This addresses the issue of absorption costing that allows income to rise as production rises.

The key difference between variable costing and absorption costing is. This is because simply enough all the possible costs are included. The cost per unit remains the same even if the level of production changes since only variable costs are included in product cost.

8 rows Difference Between Variable and Absorption Costing Variable cost is the accounting method. 10 direct materials 8 direct labor 2 variable manufacturing costs 4. If you want to understand.

Absorption costing is not the same as variable costing since this method allocates the fixed overhead costs of the products to every unit produced within a specified accounting period. In absorption costing the cost per unit decreases as the production level increases due to the absorption of fixed costs. Managerial Accounting 7th Edition Edit edition Solutions for Chapter 17 Problem 1RQ.

View Managerial Accounting TUTORIOL 5pdf from FPE ACC3101 at University of Malaya. Under absorption costing the cost per unit can be calculated as follows. Activity based costing uses multiple cost drivers to allocate costs.

6-3 Explain how fixed manufacturing overhead costs are shifted from one period to another under absorption costing. Absorption costing is a way of allocating all costs to individual production units. To maintain their formats we have their headings in the same fashion.

Creating Value in a Dynamic Business Environment 11th Edition Edit edition Solutions for Chapter 8 Problem 1RQ. Absorption Costing vs Activity Based Costing. Under an absorption cost method management can push forward costs to the next period when products are sold.

Answer Under absorption costing as a company manufacturing units of product the fixed manufacturing overhead costs of the period are added to the units along with direct materials direct labor and variable manufacturing overhead. At the end of the month Bradley has 1000 units in inventory. Absorption costing uses a single base to allocate all the costs.

Absorption costing and variable costing are two different costing approaches used by manufacturing organizations. If some of these units are. A proponent of this method would argue that it is most effective.

Briefly explain the difference between absorption costing and variable costing. Variable costing is a managerial accounting cost concept. If the company p.

Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the product-cost of production. The information provided by Variable costing method is mostly used by internal management for decision making purposesAbsorption costing provides information that is certainly used by internal management along with by external events like. Activity based costing uses multiple cost bases for cost allocation.

3900 1000 units x 390 cost 3300 1000 units x 330 cost These differences are due to the treatment of fixed manufacturing costs. This difference occurs as absorption costing treats all variable and fixed manufacturing costs as product cost while variable costing treats only the costs that vary with the output as product cost. Gross margin and contribution margin are entirely different terms.

Absorption Costing Absorption costing is a costing system that is used in valuing inventory. Under absorption costing each unit in ending inventory carries 060 of fixed overhead cost as part of product cost. Absorption costing allocates the products fixed overhead costs to every unit produced regardless of whether it was sold or not within a specified accounting period.

Under this method manufacturing overhead is incurred in the period that a product is produced. This video summarizes the ways in which operating profit or loss differs based on whether Absorption Costing or Variable Costing is used. Absorption Costing Disadvantages and Advantages.

Why do many managers prefer variable costing over absorption costing. Briefly explain the difference between absorption costing and. Variable costing and absorption costing usually produce different net operating income figures.

The method contrasts with absorption costing. Timing is the key in distinguishing between absorption and variable costing.

Difference Between Absorption Costing And Variable Costing Compare The Difference Between Similar Terms

Absorption Costing Vs Variable Costing

Variable Costing Vs Absorption Costing Top 8 Differences Infographics

No comments for "Briefly Explain the Difference Between Absorption Costing and Variable Costing"

Post a Comment